Best economic trends

1. Declining inflation: While higher interest rates proved difficult for households and businesses, they did help lower inflation. Unfortunately, they also led to lower consumer spending, which affected business profits.

The good news is that it appears the Reserve Bank of Australia’s (RBA) plan is working and inflation is on track to fall to the RBA’s target range of 2-3%.

2. Stable business conditions: Although there was a slight decline in some business conditions, overall businesses managed to weather the economic climate successfully.

3. Ultra-low unemployment: Unemployment is below pre-pandemic levels, even with a large increase in migration. The need for workers in several industries has kept employment in line with population growth. But, there was a slight increase in unemployment in the last few months of 2023, increasing from 3.6% in September to 3.9% in November, and this rise is expected to continue into the early stages of 2024.

Worst economic trends

1. Decreased consumer confidence: As high interest rates and inflation affected households, consumer confidence remained low throughout the year. With the outlook for the cash rate uncertain, there is growing concern among borrowers about their ability to keep up with loan payments.

2. Declining retail sales: Retail sales numbers were lower by the end of 2023 than the previous year. This is despite high migration levels and an increase in population, showing just how strapped for cash households are.

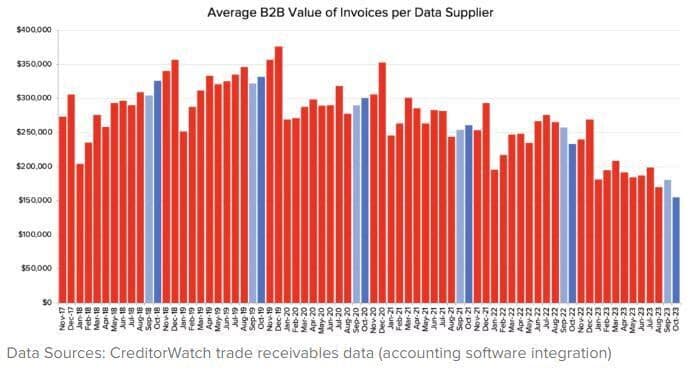

3. Reduced invoice values: The average value of invoices declined this year, showing a significant reduction in order sizes. According to CreditorWatch, there was a 34% decrease in the average value of invoices between November 2023 and the same time the previous year, with levels down to almost half the average of November 2020. In particular, small and medium-sized businesses saw the most decline.

Outlook for 2024

CreditorWatch believes that the first few months of 2024 will be particularly tough, given declining consumer confidence and the resulting subdued business trading.

Continued levels of high migration are likely to have an effect on unemployment, with the RBA forecasting unemployment may exceed 4% by the June quarter 2024. But remember that this is still below pre-pandemic levels. Federal government decisions about reducing student visas will likely ease the high demand for rental properties, particularly in capital cities. As rent is a major contributor to the consumer price index, an ease in the rental market will start to see some relief in inflation as well.

The big four banks predict the RBA will start lowering the cash rate from the final quarter of 2024.

Unfortunately, before that happens, households and businesses will still have high interest rates and high inflation to grapple with.