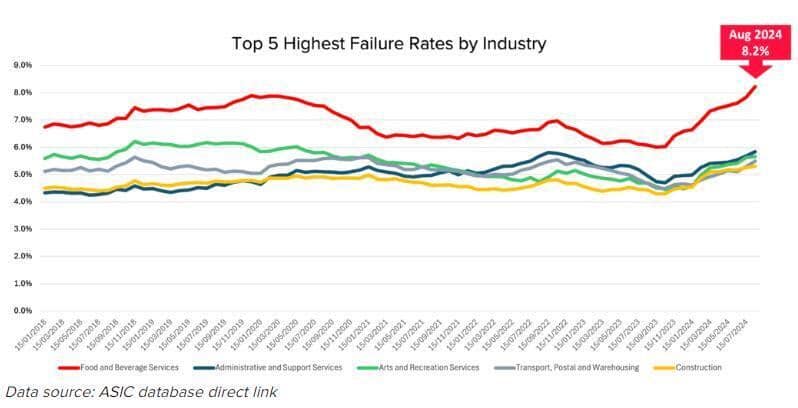

Business failures are at their highest rates since January 2021 as low levels of consumer spending, high inflation and interest rate increases put companies under increasing pressure, according to CreditorWatch.

Considering 97.2% (2.59 million) of Australia’s businesses are classified as small businesses, it stands to reason that they are most at risk.

The commercial credit reporting bureau’s August Business Risk Index (BRI) forecasts that the average failure rate for Australian businesses will increase from 4.65% to 5.20% in the 12 months to August 2025. This translates to the potential failure of more than 134,000 small businesses.

A well-crafted budget can, however, be the difference between success and failure – especially in challenging business environments.

Both the Australian Taxation Office (ATO) and the federal government’s business advice website business.gov.au emphasise the importance of creating a comprehensive budget to help small businesses manage cash flow, plan for growth and meet their tax obligations.

Whether you’re just starting out or looking to scale up, a strong budget provides the financial clarity needed for profitable operations and future growth.

Why budgeting is crucial for small businesses

Managing cash flow

Cash flow management is one of the most important aspects of running a small business, and a detailed budget is the key to staying on top of it. By calculating your income and expenses – including tax payments – you can plan for seasonal fluctuations, ensuring you have enough money to pay bills and employees.

It is also essential to understand when money comes in and when it goes out so you can make informed decisions and avoid unexpected cash shortfalls.

Planning for business growth

A budget not only helps you manage day-to-day operations but is a powerful tool for growth. It is recommended that small businesses use their budgets to assess whether they can afford to expand, invest in new equipment or hire additional staff.

This forward planning can help you avoid overextending your finances and give you a clear picture of how much capital is available for growth.

Five tips for creating an effective budget

1. Track your income and expenses

One of the first steps in creating a budget is accurately tracking your business’s income and expenses. Many small businesses use accounting software that integrates with the ATO’s systems – such as Xero and MYOB – to ensure they stay on top of their financial records.

Both the ATO and business.gov.au offer free templates and tools to help you monitor your cash flow and create your budget.

2. Plan for tax payments

It is highly advisable to regularly set aside a portion of your income to cover tax obligations. You should also regularly review your tax liabilities and incorporate them into your budget. This ensures you’ll always have the funds available when it’s time to make tax payments.

3. Include a buffer for unexpected expenses

Unexpected costs are inevitable in business, so it is essential to build a contingency fund into your budget. By setting aside a percentage of your revenue, you can safeguard your business against unforeseen costs, such as equipment repairs or fluctuations in supplier prices.

A contingency fund may also help you weather challenges arising from payment defaults.

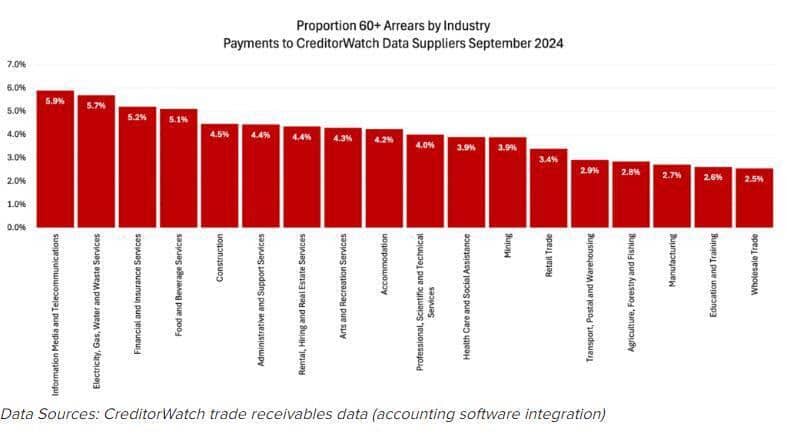

CreditorWatch’s September BRI reveals that late B2B payments are at their highest rate since the end of JobKeeper in March 2021, as more businesses struggle to pay outstanding invoices.

“Rising arrears reflect a combination of more challenging business conditions from impacts such as higher interest rates and higher costs of living/doing business,” it says.

4. Review your budget regularly

Small businesses should review their budgets regularly, either monthly or quarterly. Your budgets should then be adjusted to reflect changes in market conditions or business performance. Regular reviews ensure that your budget remains realistic and aligned with your business’ current financial situation.

5. Analyse your budget to make business decisions

If you’re spending too much, you should:

- look for ways to cut costs

- avoid spending money on anything that isn’t essential to running your business

If you have extra funds, you could consider:

- ways to reduce debt

- creating a financial safety net

- growing your business

Analysing your budget will help you find seasonal patterns. You can, therefore, see if decisions like changing prices or adding a new product or service are the right ones.